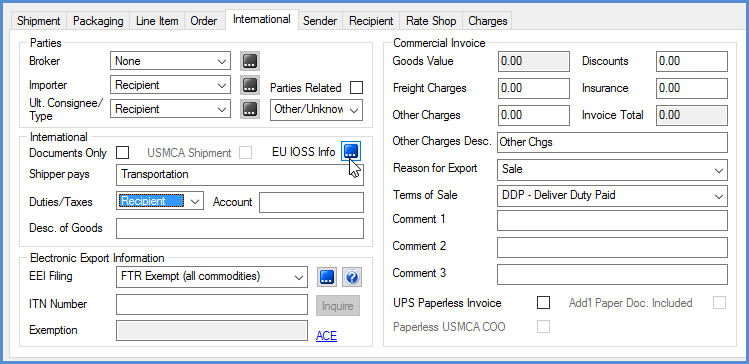

The International tab, which appears when the shipment Recipient Country is other than United States of America, allows you to enter EEI Filing information and other data that prints on the Commercial Invoice. You can specify Schedule B, EEI, and Certificate of Origin information for inventory items in Maintain Inventory.

The fields on this tab will vary depending upon the carrier you are using to process the International shipment.

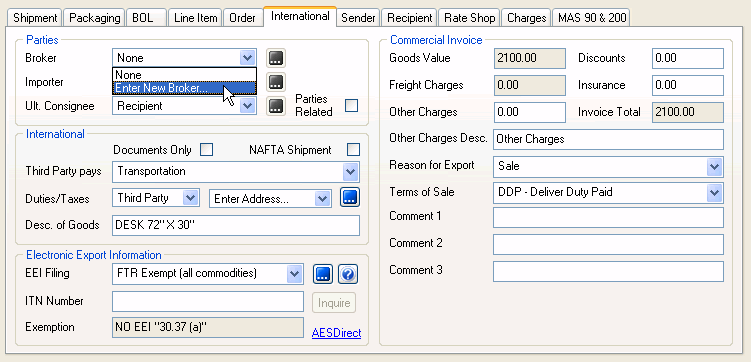

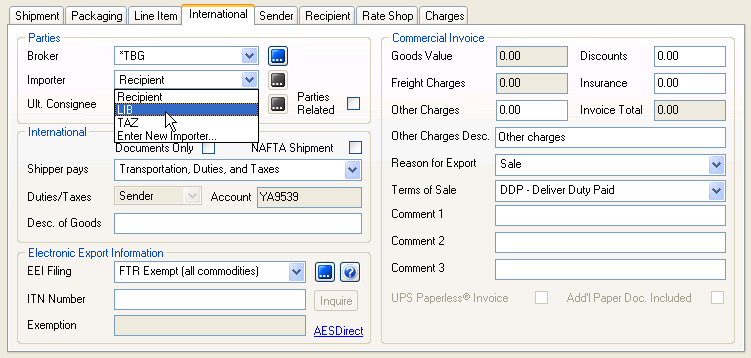

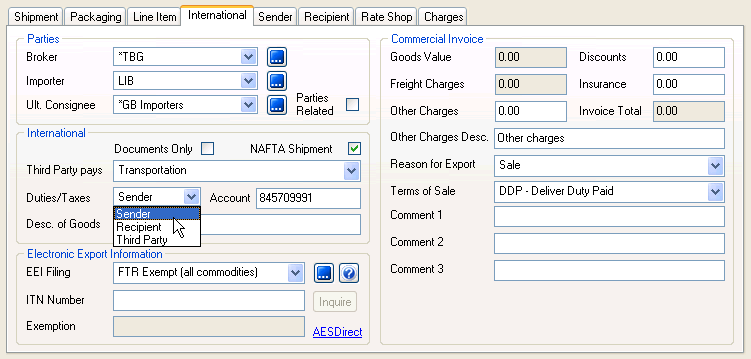

This section provides information about the parties involved in this shipment.

Brokers perform AES filing on your behalf, and give you a copy of the information that was filed and the AES Internal Transaction Number (ITN) in return. The ITN must be entered under EEI Filing in order to process this shipment.

Note: Broker is required if using Freightquote.

Select from the list of brokers you added in Maintain

Brokers, or add a new broker by selecting Enter New Broker and clicking

the ![]() button.

button.

The Importer typically pays any fees or tariffs associated with importing

goods into the country. This information prints on the Commercial Invoice.

Select from the list of importers you added in Maintain

Importers, or add a new importer by selecting Enter New Importer and

clicking the ![]() button.

button.

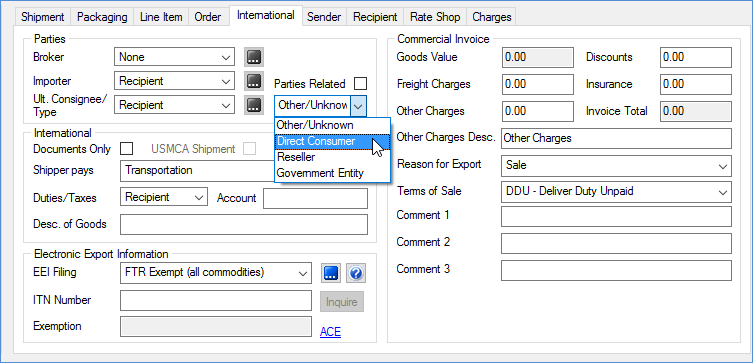

Shippers can assign a consignee to receive the exported shipment. This field is required when the Ultimate Consignee is not the recipient. You can also select “Recipient” if the Ultimate Consignee is the same as the recipient. Then select the type of consignee:

You can also add a consignee address by selecting Enter New Consignee

and clicking the ![]() button. This

information prints on the Commercial Invoice.

button. This

information prints on the Commercial Invoice.

Check the Parties Related check box if the sender and recipient are subsidiaries or divisions of the same company (At least 10% ownership between sender and recipient, or vice-versa) .

Check this box if the shipment contains only documents (items of no commercial value / not dutiable).

Check this box to print a NAFTA Certificate of Origin. This may enable you to receive tax breaks on duties and fees, and is determined by Customs.

This field name and its values change depending upon who the shipment is being billed to on the Shipment tab (Billing field). Select the portion of the shipping charges will be billed to the Shipper, Recipient, or Third Party.

Transportation

Transportation and Duties (UPS Only)

Transportation, Duties, and Taxes

Transportation to Point of Export (UPS Only)

Transportation to Point of Import (UPS Only)

This setting's field label and options depend on your selection in the field above and the Billing field on the Shipment tab.

If the shipment billing is Prepaid and the Shipper Pays field is set to anything other than Transportation, Duties, and Taxes, you can choose Recipient or Third Party from the drop-down list.

Available selections in the drop-down list also change when Recipient, Consignee, Collect, or Third Party is the Billing type on the Shipment tab.

For Third Party, you will also select an address. This can be an address

saved in Maintain Third Party Addresses or you can enter a new address

by selected Enter Address and clicking the ![]() button.

button.

If Transportation, Duties, and Taxes is selected above, these fields are populated with the Billing type and account from the Shipment tab.

Type in a description for the document or commodity. This field will be automatically populated from the Item Description entered in Maintain Inventory, if added.

EEI is required for Non-Document shipments when the following is true:

the value of any individual commodity is greater than $2500.

an export license or license exemption is required.

If the inventory item's International information has been entered in Maintain Inventory, some fields will be populated automatically.

The following values are available for EEI Filing:

FTR Exempt (all commodities) : No EEI is required because all commodities are exempt.

Filed by UPS (pre-departure) : UPS files EEI on the shipper's behalf, for a fee.

Filed By Shipper (pre-departure) : You are required to enter the International Transaction Number (ITN) provided to you by AES Direct before processing the shipment.

File By Shipper (post-departure) : You must be AES4 approved (UPS and DHL) and have the AES4 option checked in Carrier Interface Setup (under Account > Settings) .

Note: Some values may not be available to you, depending upon your carrier accounts and the selected carrier.

Set the EEI filing method from the EEI Filing

drop-down list or click the ![]() button for access to

complete EEI Filing Status information or to enter AES information (below).

button for access to

complete EEI Filing Status information or to enter AES information (below).

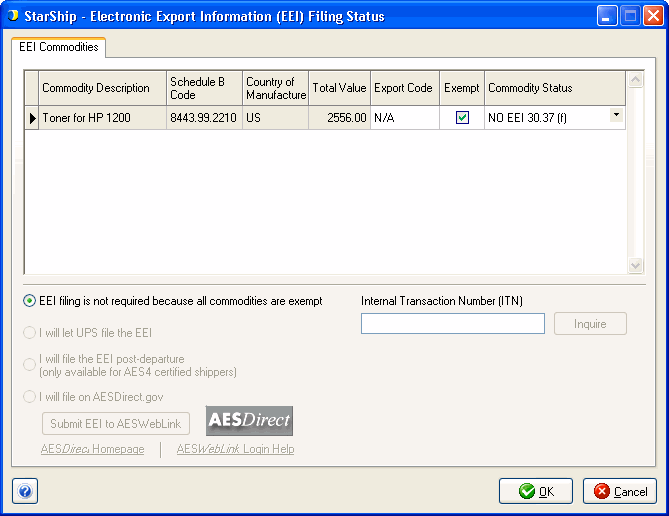

EEI Filing Status dialog

The EEI Filing Status dialog contains the information necessary to determine if EEI filing is required (or if all items are exempt). The table displays the following shipment information:

Commodity Description : Lists the Item Description from the Line Item tab for each item in the shipment.

Schedule B Code : Displays the Schedule B code from the Line Item tab for the item on this row.

Country of Manufacture : Displays the Country of Manufacture from the Line Item tab for the item on this row.

Total Value : Displays the Total Value from the Line Item tab for the item on this row.

Export Code : If the item is not exempt, displays the Export Code. You can make another selection from the drop-down list. The default setting is OS (all other shipments).

Exempt : To define a commodity as exempt, check the Exempt check box and select an exemption from the Commodity Status drop-down list.

Commodity Status : Displays

the EEI Filing Status of the item. Values include Exempt, ITAR, Licensed,

etc.

Common exemptions are 30.36 (shipments to

Canada, regardless of value) and 30.37(a) (Shipments under $2500 per schedule

B item). You cannot select this option if you are shipping to any of the

following countries: CU (Cuba), IR (Iran), KP (North Korea), SD (Sudan),

or SY (Syria).

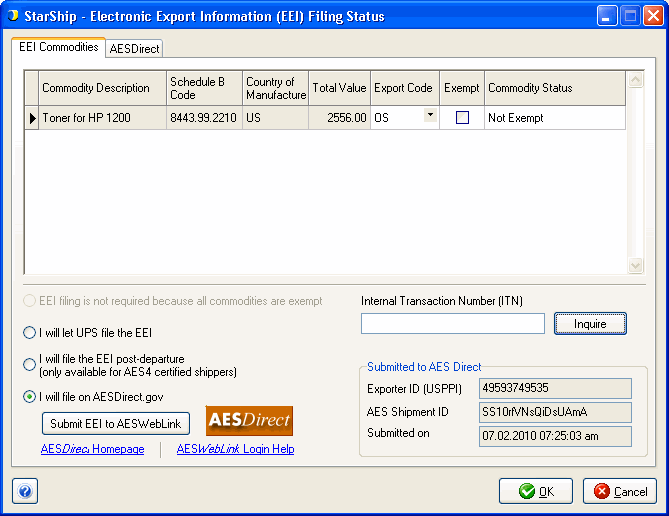

UPS files the EEI information for you based on information uploaded in the PLD. You do not need to enter an ITN to process the shipment.

StarShip prints the "FedEx Export Agent File - Manual Express" form, and then the shipper faxes it to FedEx and receives an ITN by fax in return. The ITN then needs to be entered in StarShip.

This option does not require an ITN to process the shipment and is available only for AES4 certified shippers (UPS).

This is automatically selected when the shipment is not exempt and the carrier is USPS. Click the Submit link to send the EEI to AESDirect. When prompted, enter your AESDirect username and password and click Continue.

If the shipment is successfully accepted for processing, the Exporter and AES Shipment IDs, and the date, appear on the EEI Filing Status dialog. An email response (with an ITN, if the shipment was accepted) will be sent to the email address you provided to AES.

If AES email settings are configured in International Preferences, StarShip will retrieve the ITN from the AES response email and populate the ITN.

If you are not using automatic ITN retrieval, open the AES response email to copy and paste the ITN.

Use the Inquire button

on this dialog or on the Shipment tab

to find out the status of the ITN.

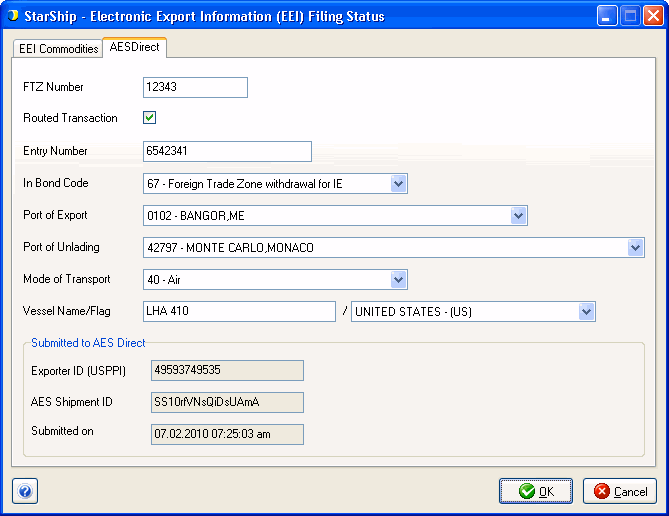

This tab is enabled when you file on AESDirect.gov.

FTZ Number : This is the Foreign Trade Zone number and pertains to In Bond shipments with codes 67 (Immediate Exportation from a Foreign Trade Zone) and 68 (Transportation and Exportation from a Foreign Trade Zone).

Routed Transaction : Check this check box if the foreign principal party in interest (FPPI) is responsible for Export Licensing.

Entry Number : This field is enabled when Routed Transaction is checked. Type in the Entry Number.

In Bond Code : Select the In Bond code type.

36 - Warehouse withdrawal for Immediate Export

37 - Warehouse withdrawal for Transportation and Exportation

67 - Foreign Trade Zone withdrawal for Immediate Export

68 - Foreign Trade Zone withdrawal for Transportation and Exportation

Port of Export : Select a port from the drop-down list. This information is automatically determined for some carriers. If you need to enter this information, contact the carrier for the Port of Export.

Port of Unlading : Select a port from the drop-down list. Enter the port of unlading if the shipment is being transported on a ship (vessel). If necessary, contact the carrier for this information.

Mode of Transport : Select a mode of transport code from the drop-down list. This setting is automatically determined for some carriers. If you need to enter the mode of transport, contact the carrier for this information.

Typically settings are 30 (Truck) or 40 (Air).

Vessel Name / Flag : This setting applies only to vessel shipments. Enter the name of the ship and select the vessel's flag in the country drop-down list.

See also : UPS Parcel Setup, TForce Freight Setup, DHL Setup, FedEx Setup

UPS has added support for the European Union’s Value Added Tax (VAT) new rules impacting imports into the EU valued up to €150.

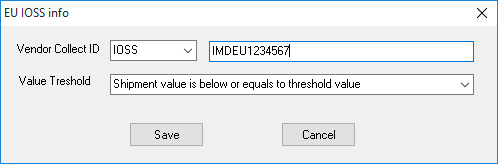

There are several additional fields on the International tab for shipments to the EU if the shipper collects the VAT charge at the time of sale. Click the EU IOSS Info button to access these fields.

Vendor Collect ID Type Code

OSS (One Stop Shop)

VOEC (VAT on Ecommerce – Norway)

HMRC (UK)

Vendor Collect ID Number

Enter your VAT Tax collection registration number. Entering this number implies that you as the shipper have collected or paid the required VAT tax.

Value Threshold

Choose whether the value of the shipment is below/equal to the threshold value, above the threshold value, or if this is not applicable.

The following information is printed on the Commercial Invoice.

This field is calculated based on the inventory item and quantities.

The discount amount will be subtracted from the freight charges.

Enter the value of the freight charges.

Enter the insurance amount.

Enter any other charges, and either type a description or accept the default, in the fields provided.

This is the total value of the commercial invoice, which is Goods + Freight + Insurance + Other - Discount, and is divided equally among the packages.

Select a reason for export from the drop-down list.

The Terms of Sale are shorthand expressions that set out the rights and obligations of each party when it comes to transporting the goods. Select a term from the drop-down list.

Available Terms

EXW (Ex Work): The seller fulfills the obligation to deliver when he or she has made the goods available at his/her premises (i.e., works, factory, warehouse, etc.) to the buyer. In particular, the seller is not responsible for loading the goods in the vehicle provided by the buyer or for clearing the goods for export, unless otherwise agreed. The buyer bears all costs and risks involved in taking the goods from the seller's premises to the desired destination. This term thus represents the minimum obligation for the seller.

FCA (Free Carrier): The seller fulfills their obligation when he or she has handed over the goods, cleared for export, into the charge of the carrier named by the buyer at the named place or point. If no precise point is indicated by the buyer, the seller may choose, within the place or range stipulated, where the carrier should take the goods into their charge.

FAS (Free Alongside Ship): The seller fulfills his obligation to deliver when the goods have been placed alongside the vessel on the quay or in lighters at the named port of shipment. This means that the buyer has to bear all costs and risks of loss of or damage to the goods from that moment.

FOB (Free On Board): The seller fulfills his or her obligation to deliver when the goods have passed over the ship's rail at the named port of shipment. This means that the buyer has to bear all costs and risks to loss of or damage to the goods from that point. The FOB term requires the seller to clear the goods for export.

CFR (Cost and Freight): The seller pays the costs and freight necessary to bring the goods to the named port of destination, Terms of Sale but the risk of loss of or damage to the goods, as (continued) well as any additional costs due to events occurring after the time the goods have been delivered on board the vessel, is transferred from the seller to the buyer when the goods pass the ship's rail in the port of shipment. The CFR term requires the seller to clear the goods for export.

CIF (Cost, Insurance and Freight): The seller has the same obligations as under the CFR but also has to procure marine insurance against the buyer's risk of loss or damage to the goods during the carriage. The seller contracts for insurance and pays the insurance premium. The CIF term requires the seller to clear the goods for export.

CPT (Carriage Paid To): The seller pays the freight for the carriage of the goods to the named destination. The risk of loss of or damage to the goods, as well as any additional costs due to events occurring after the time the goods have been delivered to the carrier, is transferred from the seller to the buyer when the goods have been delivered into the custody of the carrier. If subsequent carriers are used for the carriage to the agreed upon destination, the risk passes when the goods have been delivered to the first carrier. The CPT term requires the seller to clear the goods for export.

CIP (Carriage and Insurance Paid To): The seller has the same obligations as under CPT, but with the addition that the seller has to procure cargo insurance against the buyer's risk of loss of or damage to the goods during the carriage. The seller contracts for insurance and pays the insurance premium. The buyer should note that under the CIP term the seller is required to obtain insurance only on minimum coverage. The CIP term requires the seller to clear the goods for export.

DAF (Delivered At Frontier): The seller fulfills his obligation to deliver when the goods have been made available, cleared for export, at the named point and placed at the frontier, but before the customs Terms of Sale border of the adjoining country.

DAP (Delivered At Place): With DAP, the seller is responsible for the final part of the shipment's journey, while the buyer is responsible for the final unloading of the goods. The seller delivers when the goods are placed at the disposal of the buyer on the arriving means of transport, ready for unloading at the named destination. The seller agrees to pay all costs and suffer any potential losses of moving the goods to the destination.

DDU (Delivered Duty Unpaid): The seller fulfills his obligation to deliver when the goods have been made available at the named place in the country of importation. The seller has to bear the costs and risks involved in bringing the goods thereto (excluding duties, taxes and other official charges payable upon importation) as well as the costs and risks of carrying out customs formalities. The buyer has to pay any additional costs and to bear any risks caused by failure to clear the goods in time.

DDP (Delivered Duty paid): The seller fulfills his obligation to deliver when the goods have been made available at the named place in the country of importation. The seller has to bear the risks and costs, including duties, taxes and other charges of delivering the goods thereto, clear for importation. While the EXW term represents the minimum obligation for the seller, DDP represents the maximum.

DES (Delivered Ex Ship): The seller fulfills his/her obligation to deliver when the goods have been made available to the buyer on board the ship, uncleared for import at the named port of destination. The seller has to bear all the costs and risks involved in bringing the goods to the named port destination.

DEQ (Delivered Ex Quay, [Duty Paid]): The DDU term has been fulfilled when the goods have been available to the buyer on the quay (wharf) at the named port of destination, cleared for importation. The seller has to bear all risks and costs including duties, taxes and other charges of delivering the goods thereto.

Enter extra comments to print on the commercial invoice.

UPS Paperless Invoice includes paperless NAFTA Certificate of Origin for shipments between the United States and Canada. This is a contract service that is enabled/disabled automatically by UPS. When checked, StarShip prints the shipments Commercial Invoice information in barcodes on the thermal label. This replaces the regular Commercial Invoice Form.

When you check UPS Paperless Invoice, this check box is enabled. Check this option to print a copy of the paperless invoice to the thermal printer in addition to the thermal label.

If the thermal label printer does not support the barcode used, you can still print the paperless invoice.

The Paperless NAFTA Certificate of Origin is just like the printed version of a NAFTA Certificate of Origin except your commercial trade data is transmitted electronically directly to UPS. You no longer need to print out or attach the NAFTA Certificate of Origin to your shipment.

This check box is available for UPS accounts that have the Paperless NAFTA contract service enabled by UPS. (Contract services are shown for the UPS account on the Accounts tab in UPS Setup).

Paperless NAFTA CO is available only for NAFTA shipments (when Certificate of Origin is set to NAFTA or Standard for the line item) when the recipient is located in Canada or Mexico.

See also : Manage Templates (for Commercial Invoice), Maintain Inventory > International,